The exchange rate between the British Pound Sterling (GBP) and the Indian Rupee (INR) is a dynamic figure that constantly fluctuates based on a multitude of economic and geopolitical factors. Understanding these fluctuations is crucial for individuals and businesses involved in international trade, travel, and investment.

Key Factors Influencing GBP/INR Exchange Rates

Several key factors contribute to the ebb and flow of the GBP/INR exchange rate:

Economic Growth and Performance: The relative economic health of both the UK and India plays a significant role. Strong economic growth in India can increase demand for the Rupee, while robust growth in the UK can boost demand for the Pound. Factors like GDP growth, inflation rates, and employment figures in both countries are closely monitored.

Interest Rate Differentials: Interest rate policies of the Bank of England and the Reserve Bank of India significantly influence currency values. Higher interest rates in a country generally attract foreign investment, increasing demand for its currency.

Political Stability and Geopolitical Events: Political instability in either country can create uncertainty and negatively impact investor confidence, leading to currency depreciation. Global events such as Brexit, trade wars, and geopolitical tensions also have a profound impact on exchange rates.

Commodity Prices: India is a major importer of commodities, and fluctuations in global commodity prices, particularly oil prices, can significantly impact the Rupee. A rise in oil prices can increase India’s import bill, weakening the Rupee.

Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI): Inflows of FDI and FPI into India can strengthen the Rupee, while outflows can weaken it. These flows are influenced by factors such as investor sentiment, economic outlook, and government policies.

Speculation and Market Sentiment: Currency markets are susceptible to speculation and herd behavior. Market sentiment, driven by news, rumors, and analyst predictions, can cause significant short-term fluctuations in exchange rates.

Where to Find the Latest GBP/INR Exchange Rate

Online Currency Converters: Numerous online platforms, such as Google Finance, XE.com, and Yahoo Finance, provide real-time and historical GBP/INR exchange rates. These platforms often include currency conversion calculators and charts to help you track rate movements.

Financial News Websites: Major financial news outlets, such as Bloomberg, Reuters, and the Financial Times, regularly report on currency exchange rates, including GBP/INR. These websites often provide analysis and commentary on the factors driving currency movements.

Banks and Financial Institutions: Banks and financial institutions provide up-to-date exchange rates for their customers. You can check with your bank or visit their website for the latest rates.

Forex Brokers: Forex brokers specialize in foreign exchange trading and provide real-time exchange rate quotes to their clients.

Factors to Consider When Converting GBP to INR

Timing: Currency exchange rates fluctuate constantly. Timing your conversion can significantly impact the amount of Rupees you receive. If you are not in a hurry, it may be beneficial to wait for a more favorable exchange rate.

Fees and Charges: Banks, money transfer services, and other financial institutions may charge fees for currency conversions. It’s essential to compare fees and charges from different providers to ensure you get the best deal.

Exchange Rate Volatility: Currency markets can be volatile, and exchange rates can fluctuate significantly within short periods. If you are concerned about potential losses due to exchange rate fluctuations, you may consider using hedging strategies or locking in a specific exchange rate.

Historical Trends

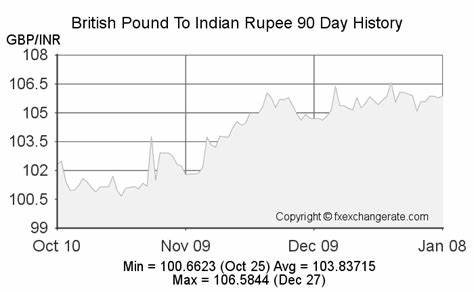

Analyzing historical trends provides valuable insights into potential future movements.

Long-Term Trend: Over the past decade, the GBP has generally experienced fluctuations against the INR. Factors such as economic growth in both countries, political developments, and global events have significantly impacted the exchange rate.

Short-Term Volatility: The exchange rate exhibits significant short-term volatility due to the aforementioned factors. News announcements, economic data releases, and unexpected events can cause sudden and significant shifts in the exchange rate.

GBP/INR Exchange Rate Forecast

Predicting future exchange rates is a complex task and involves a high degree of uncertainty. Economic and geopolitical events can significantly impact currency values, making accurate forecasts challenging. However, analysts and economists often provide forecasts based on their assessment of various economic indicators and market conditions.

Tips for Managing Currency Exchange Risks

Stay Informed: Keep abreast of economic and political developments that could impact the GBP/INR exchange rate.

Monitor Exchange Rates: Regularly check exchange rate movements to identify potential opportunities.

Consider Hedging Strategies: Explore hedging options, such as forward contracts or options, to mitigate exchange rate risk.

Use Currency Forward Contracts: A forward contract allows you to lock in a specific exchange rate for a future date, reducing the risk of exchange rate fluctuations.

Utilize Currency Options: Currency options give you the right, but not the obligation, to buy or sell a currency at a specific price within a certain timeframe.

Final Thoughts

The GBP to INR exchange rate is a complex and dynamic relationship influenced by numerous factors. While predicting future movements with certainty is impossible, understanding the key drivers and historical trends can help individuals and businesses make informed decisions. By staying informed, diversifying investments, and considering risk management strategies, you can navigate the ever-changing currency landscape and mitigate potential losses.

FAQs

What is the GBP to INR exchange rate?

The GBP to INR exchange rate signifies the value of one British Pound Sterling (GBP) expressed in Indian Rupees (INR). In simpler terms, it tells you how many Indian Rupees you can obtain for a single British Pound. This rate is constantly in flux, influenced by a variety of economic and global factors.

How can I manage currency risk when dealing with GBP to INR?

Managing currency risk is crucial for businesses and individuals. Strategies include staying informed about economic and market news, utilizing forward contracts to lock in exchange rates for future transactions, diversifying investments across different currencies, and implementing hedging strategies to mitigate the impact of unfavorable currency movements.

How does the GBP to INR exchange rate impact businesses?

Businesses engaged in trade between the UK and India are significantly affected by the exchange rate. A stronger Pound can make UK exports more expensive for Indian customers, while imports from India become cheaper. Conversely, a weaker Pound can make UK exports more competitive in the Indian market.

To read more, Click Here